Facing the tax deadline can be daunting, especially when you’re not ready to file. That’s where Form 4868 comes into play, offering a much-needed reprieve by extending the filing deadline. It’s the IRS’s way of giving taxpayers extra time without added stress.

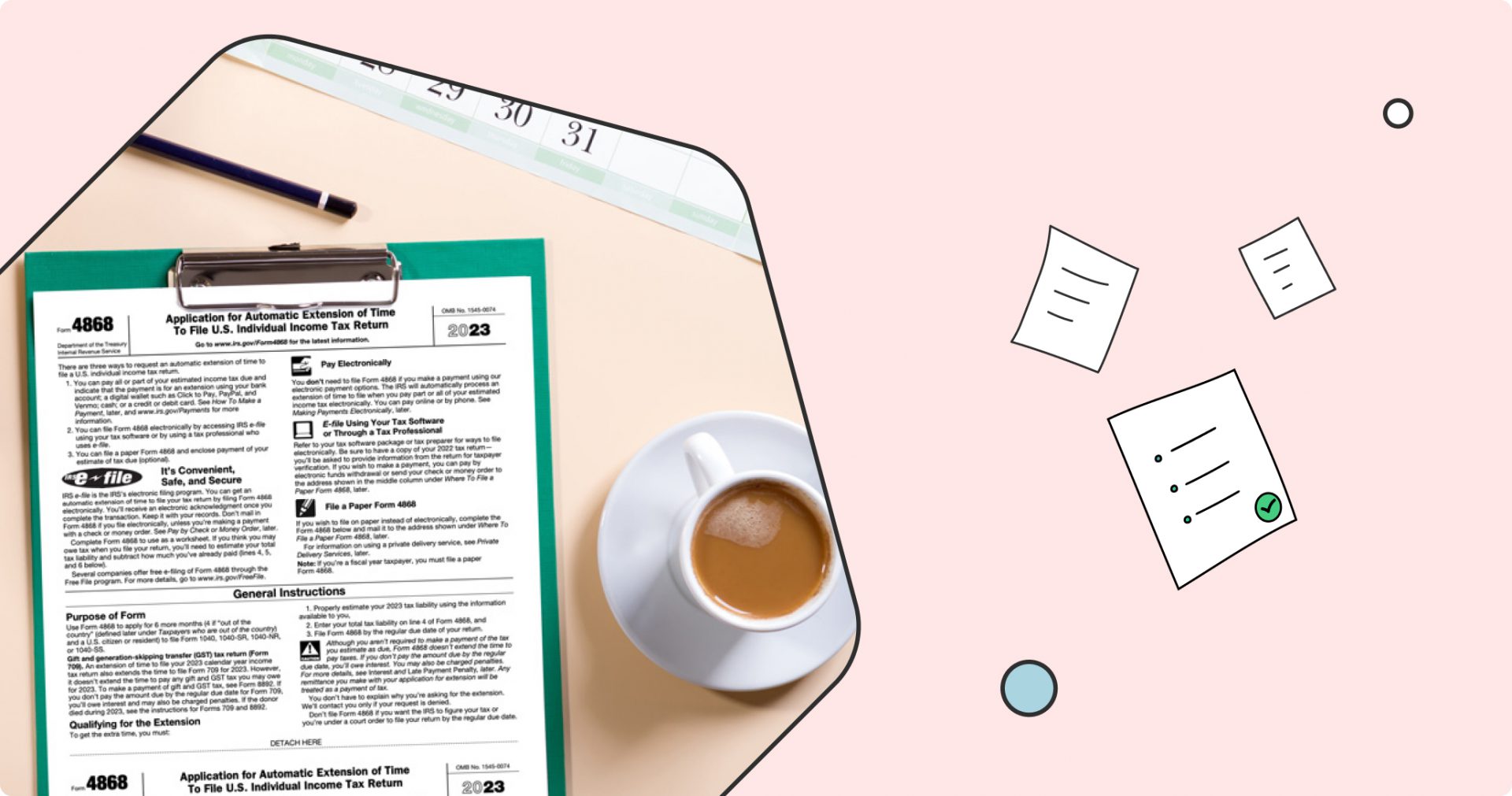

What is Form 4868 used for?

Form 4868 is essentially a request for more time to file your federal income tax return. Instead of rushing through your documents and risking mistakes, this form grants you an additional six months, ensuring you can file accurately and confidently.

Who can file Form 4868?

Virtually any individual taxpayer is eligible to use Form 4868, regardless of their specific tax situation. This includes:

- Individuals, regardless of their employment status, whether employed, self-employed, or unemployed.

- Married couples who plan to file jointly, ensuring both parties are covered under the single extension request.

- Taxpayers living abroad who need additional time to gather foreign income documentation or to understand their US tax obligations better.

Understanding your eligibility can alleviate the stress of the tax deadline and provide the necessary time to organize your financial records accurately.

When is Form 4868 due?

Mark your calendar for the traditional tax deadline of April 15th, as this is also when Form 4868 must be submitted to avoid penalties. However, if April 15th falls on a weekend or public holiday, the due date for filing your tax return and it is extended to the next business day. This extension is automatic, requiring no additional paperwork.

How to fill out Form 4868

To successfully complete Form 4868 ¹ , follow these steps:

- Personal information: Start with your full name, address, and Social Security Number. If filing jointly, include your spouse’s information.

- Estimate of total tax liability: Based on your records, estimate your total tax liability for the year. This doesn’t have to be exact but should be as accurate as possible based on the information you have.

- Total payments: Include the total of what you’ve already paid towards your tax liability, including withholding and estimated tax payments.

- Balance due: Calculate the difference between your estimated tax liability and total payments. If you expect to owe, this is the amount you’re estimating.

- Amount you are paying: If you can, include a payment with your extension request to reduce or eliminate interest and penalties on the amount you owe.

Remember, the extension is for filing your tax return, not for any tax owed. If you expect to owe taxes, it’s best to pay as much as you can with the extension to minimize additional charges.

Instructions for Form 4868

The IRS instructions for Form 4868 ² offer valuable guidance on each part of the form, including how to:

- Accurately estimate your tax liability based on your current financial information.

- Determine the best way to make any payment you owe to reduce future penalties and interest.

- Utilize IRS Direct Pay or electronic payment options for a more secure and immediate payment method alongside your extension request.

Does Form 4868 include state taxes?

It’s important to note that Form 4868 applies only to federal income tax returns. State tax extensions are a separate process governed by individual state tax agencies. Always check your state’s requirements to stay compliant.

Does Form 4868 require a signature?

One of the conveniences of Form 4868 is that it doesn’t typically require a signature. This simplifies the process further, making it easier to file and obtain your extension.

Where do I mail Form 4868?

If you choose to file a paper version of Form 4868, the mailing address will depend on your location and whether you’re making a payment. The IRS provides a list of addresses to ensure your form reaches the right office.

Can I file Form 4868 online?

Yes, the IRS encourages electronic filing, and Form 4868 is no exception. Filing online is faster, more secure, and provides immediate confirmation of your extension request.

How to file Form 4868 online

For a hassle-free filing experience, consider these steps to file Form 4868 online:

- Choose an IRS-approved e-file provider: Research and select an e-file service authorized by the IRS and fits your needs.

- Prepare your information: Gather your personal information, estimated tax liability, and any payment information if you plan to make a payment with your extension.

- Follow the software guidance: The e-file software will provide step-by-step instructions to fill out the form. Input your information as prompted.

- Review and submit: Double-check all the information for accuracy, then submit your form through the software. You’ll receive an electronic confirmation for your records.

Let Workhy file your company’s taxes on your behalf

For entrepreneurs and business owners, especially those from abroad, navigating US tax obligations can be complex. Our services are designed to simplify this process, offering support in company formation, tax filing, and ensuring timely submissions, including extensions with Form 4868. With our expertise, you can focus on growing your business, confident that your tax obligations are managed efficiently.

Beyond tax extensions, Workhy offers a comprehensive suite of services to support your business needs, from EIN & ITIN applications to bookkeeping, from opening online bank accounts to providing registered agents and addresses. Partner with us for a streamlined approach to your business and tax responsibilities, ensuring compliance and peace of mind. Schedule a meeting to see how we can assist you in your entrepreneurial journey, making tax time less taxing.