Set up a company in Estonia and runeverything online.

Workhy helps with every step of setting up a company in Estonia so that you can grow your business hassle-free with professional support.

Register Now

Partners

Become a member. Upload your documents.

You're all set.

1

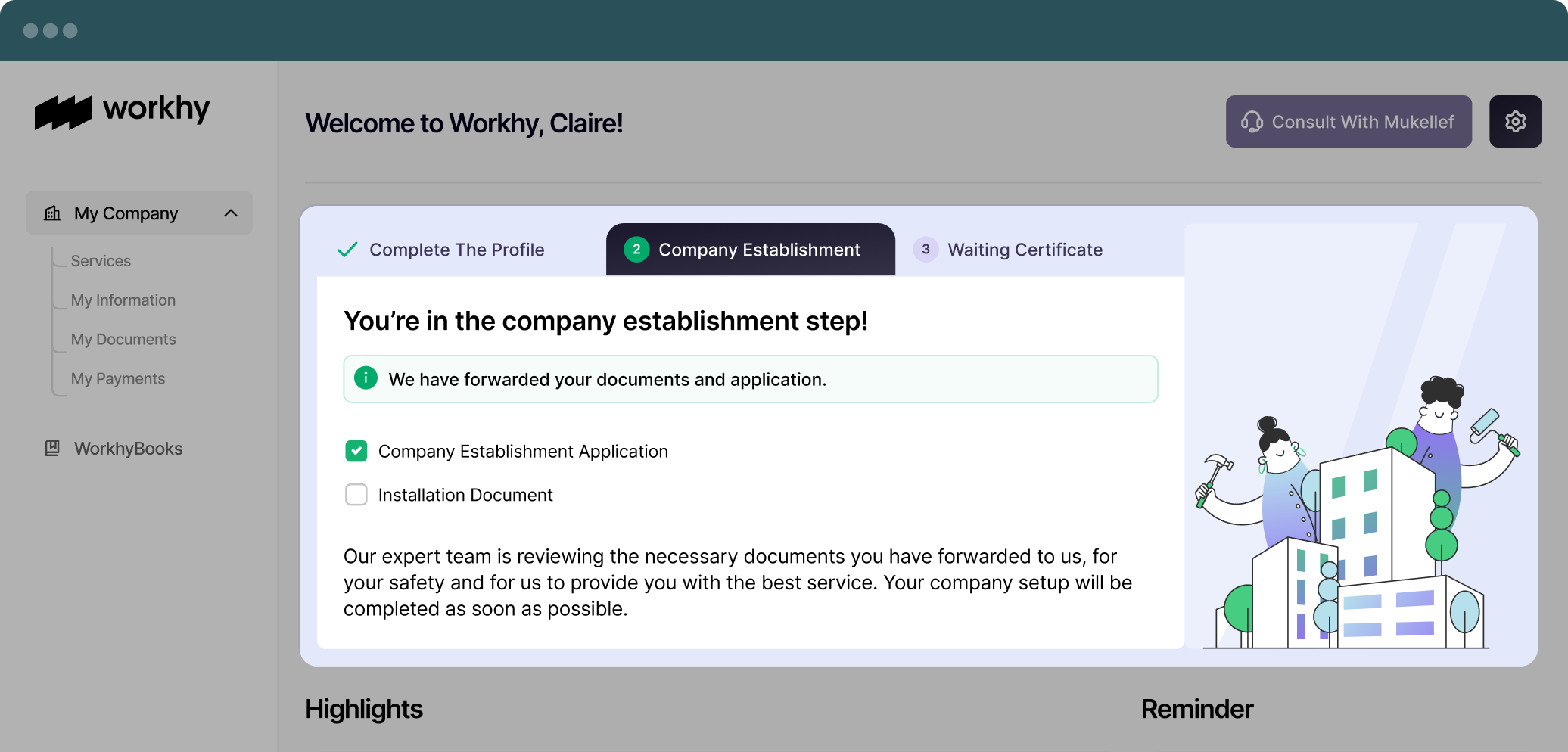

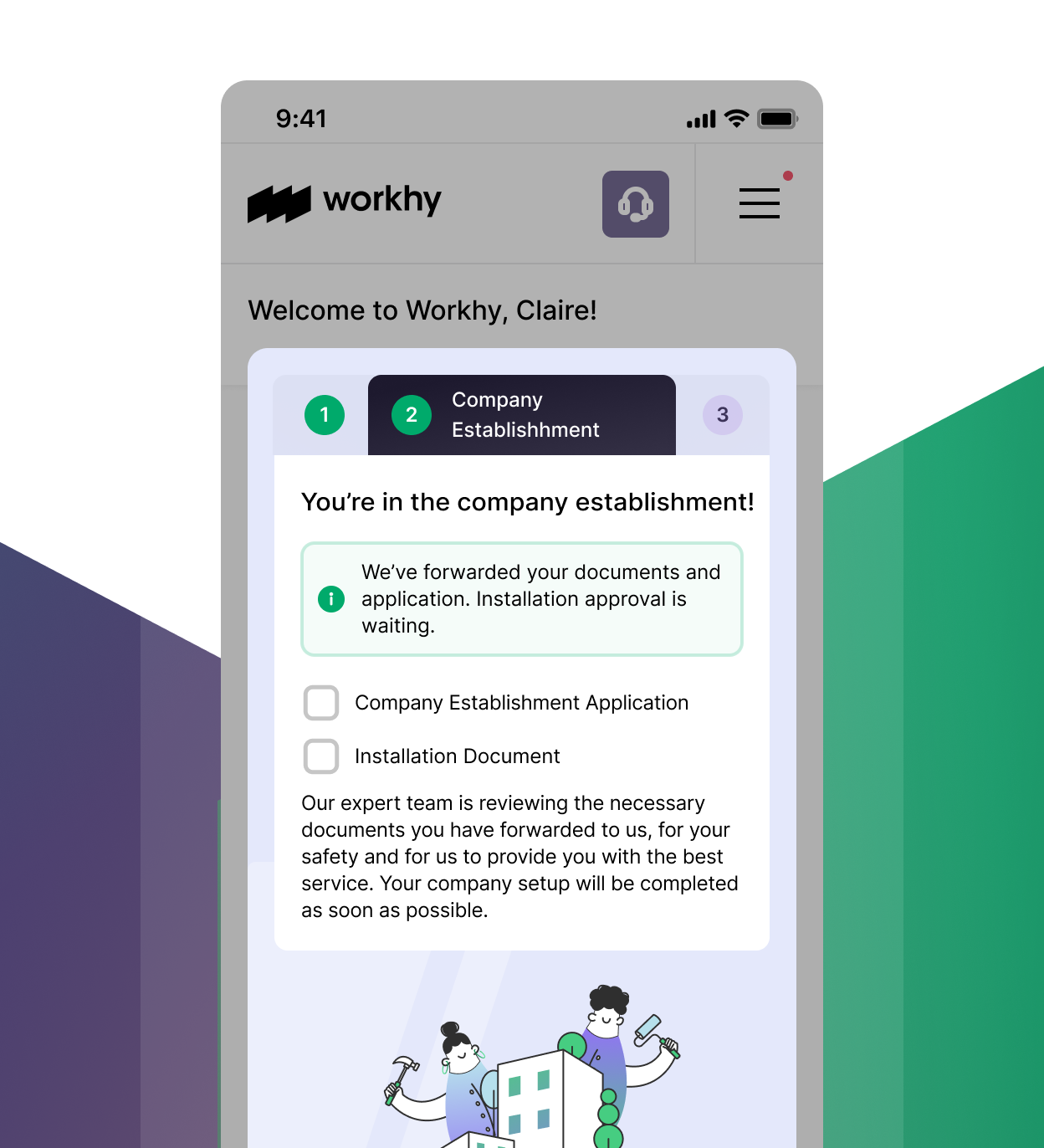

1Register with Workhy Now!

Register with Workhy in minutes, provide the necessary information and documents, and enjoy the convenience of quickly establishing a company in Estonia.

2

2Sign Your Documents

Give your approval by signing via e-Residency the company establishment petition prepared by our team in line with your provided information. After your establishment fee is paid, your petition will be forwarded to the relevant authority in Estonia.

- 3

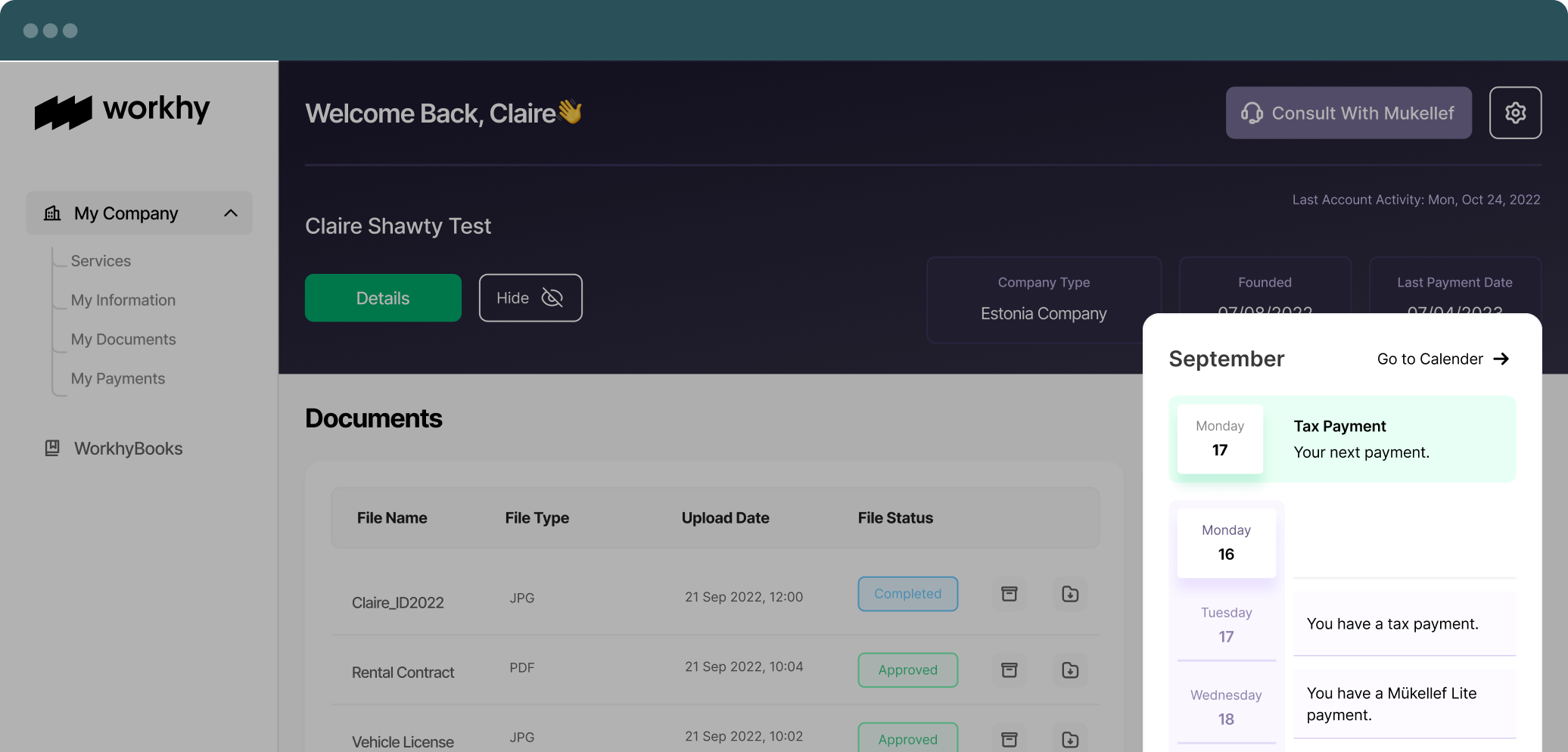

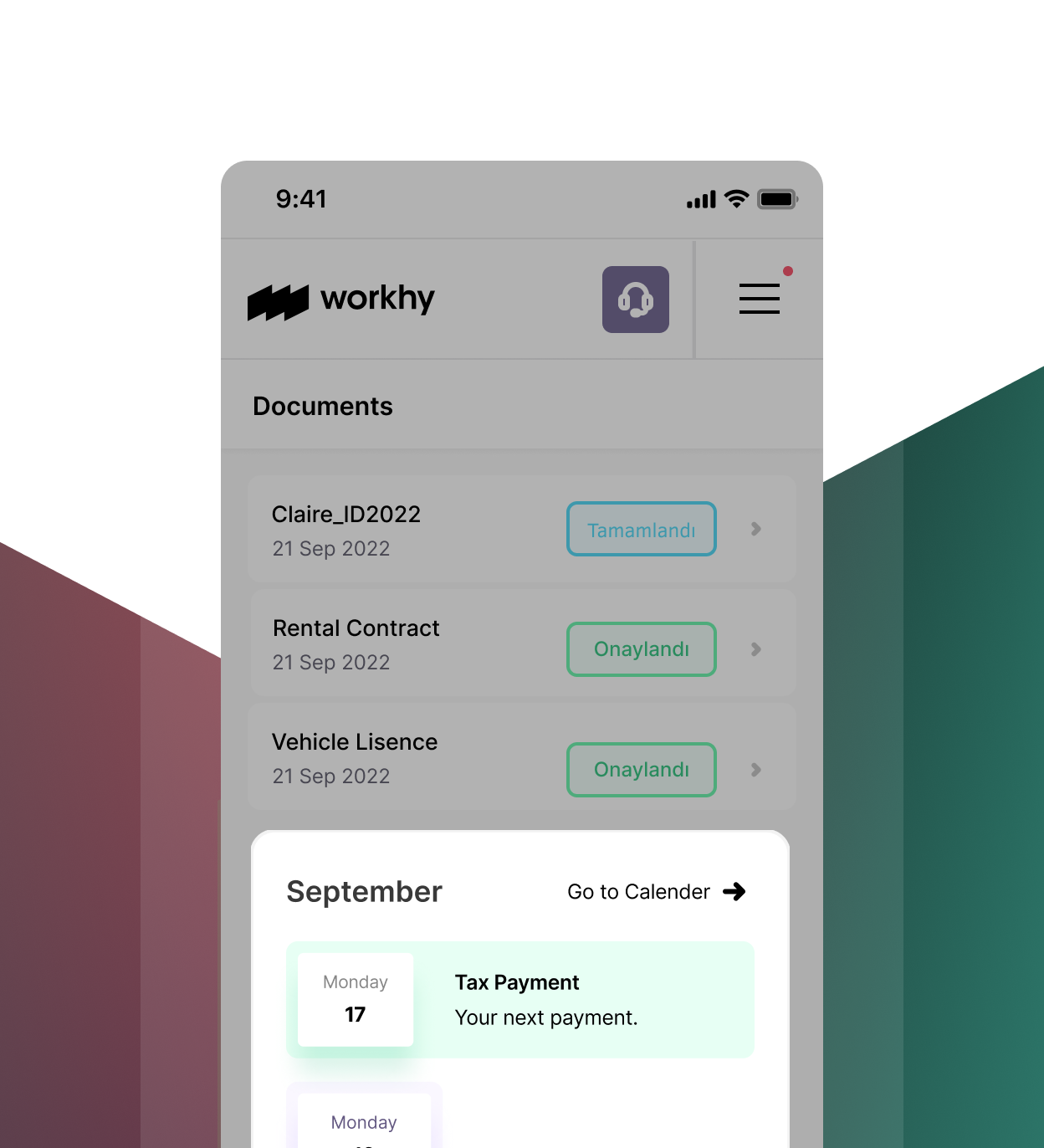

You're Ready to Manage Your Company

Congratulations! You're now a business owner in Estonia! After your approved company formation documents are uploaded to your Workhy account, you can start managing your Estonia-based company online from anywhere in the world.

Advantages of establishing a company in Estonia.

Online Company Establishment

It is possible to establish a company and open a bank account online without traveling to Estonia.

e-Residency

Thanks to the e-Residency system in Estonia, you can manage your company online, sign the necessary documents, and pay taxes from anywhere in the world.

Tax Exemption

VAT exemption of up to €40,000 in taxable income within 1 year provides a significant advantage for small entrepreneurs establishing a company in Estonia.

Advanced Startup Ecosystem

In Estonia, which has a developed startup ecosystem, the number of angel investors and incubation centers is much higher than in other countries in the European Union.

Visa Ease

Teams with technology or software-based business ideas can obtain a residence and work permit for 1-3 years without a language test or interview with an Estonian startup visa.

0% Corporate Tax

In Estonia, no corporate tax is collected on undistributed and reinvested profits. Thanks to this tax exemption, you can expand your company by using the profit you earn for investment purposes. In case of profit sharing, the corporate tax rate is 20%.

Company Estabilishment

Start your company establishment process in the Netherlands quickly and safely with Workhy and complete all processes efficiently. Digitally view and download documents related to your company at any time.

Tax Processes

Get support from Workhy for your company's accounting and tax processes in Estonia. Your tax returns will be prepared by our contracted accountants in line with the information and documents you will submit.

Get started with your company establishment process in Estonia now.

Estonia Blog Posts

Frequently Asked Questions