When it comes to business compliance, it’s no secret that the Internal Revenue Service (IRS) requires a host of information, but what do you do if you are a non-resident alien (NRA) or a foreign-domiciled business that has an income in the US without citizenship or residency?

The w-8 ben form was designed with you in mind and can help you claim exempt status from withholdings, collect relevant taxpayer information, and keep a record of status when tax reporting is necessary. The form w 8 ben is not issued by the Internal Revenue Service but instead by the individual or entity you work with and will be used to verify your country of residence. If you need help filling out the w 8 ben form or you would like some detailed w-8 ben instructions, you’ll find everything you need to know in this article.

What is the W-8 Ben?

This tax form is used to define exactly how much tax needs to be paid by non-resident aliens who work either within the US without residency or have been working remotely from another country and are paid for their services. In short, if you are a foreign individual and receive income in the US, the w 8 ben establishes that you are not a US citizen and that you own the business. It is often referred to as a certificate of foreign status.

What is the purpose of the W-8 Ben form?

Individuals in the above cases are subjected to a 30% tax rate on all income received from US sources. This can include everything from dividends to royalties, substitute payments, compensation for services, or any other US-based gains, profits, or income, so filling out a w-8 ben form can be extremely important when ensuring that all fees are paid and tax breaks are awarded correctly.

Who should fill out the W-8 Ben form?

It’s important to understand that the w 8 ben form is the correct documentation for non-resident alien individuals to record income payments, whether they come from inside or outside of the US. Business entities will typically be required to fill out the w 8 ben e instead.

Those who are the single owner of an NRA-classified foreign financial institution, disregarded entities, or are non-U.S. transferors of partnership interests for financial gain will also be required to fill out and file the w 8 ben form. If you are a former US resident on a retirement income from the US or occasionally partake in freelance work, you may also need to submit the w 8 form, so keep this in mind.

W-8 Form tax benefits

Form w-8 ben helps non-resident alien individuals keep record of their transactions and prove their eligibility for reduced rates for tax withholding. Some may even be entirely exempt if their country has an income tax treaty, for example:

- Canada

- Mexico

- Finland

- Israel

- Japan

- The Philippines

- Venezuela

Reduced tax rates typically come in the form of either a 15% reduction on tax for dividends or 0% taxation on interest.

While the benefits may not be numerous, it is certainly worth complying with US taxation laws and potentially saving money that you wouldn’t otherwise need to pay out.

How to fill out W 8 Ben form

Filling out a w 8 ben form will typically follow standard procedure and will include:

- Entering your name as the beneficial owner

- Filling out personal details such as date of birth

- Disclosing your country of citizenship and entering your permanent residence/mailing address

- Entering your U.S. taxpayer identification number and your foreign tax identification number

- Claiming tax treaty benefits by submitting your country (whose tax laws you claim tax benefits under) if it has a US tax treaty

- Add any special rates and conditions that may be applicable

- Certify that all information is true and correct by signing and dating the w 8 ben at the end

When following these w-8 ben instructions, the form can be downloaded, but you can also work with a specialized team of single-platform financial operators such as Workhy, who have the tools and expertise to help you through every step of the process.

How to Download W-8 Ben form

The individual or entity needing the w-8 ben will typically send the form out themselves. There may be instances where you are asked to download the form yourself, and this is readily available online:

- Go to the gov website

- Search for the w 8 ben form

- Click to download the PDF

- Either use PDF editing software and print or print and manually fill out the form

- Send it to the relevant parties

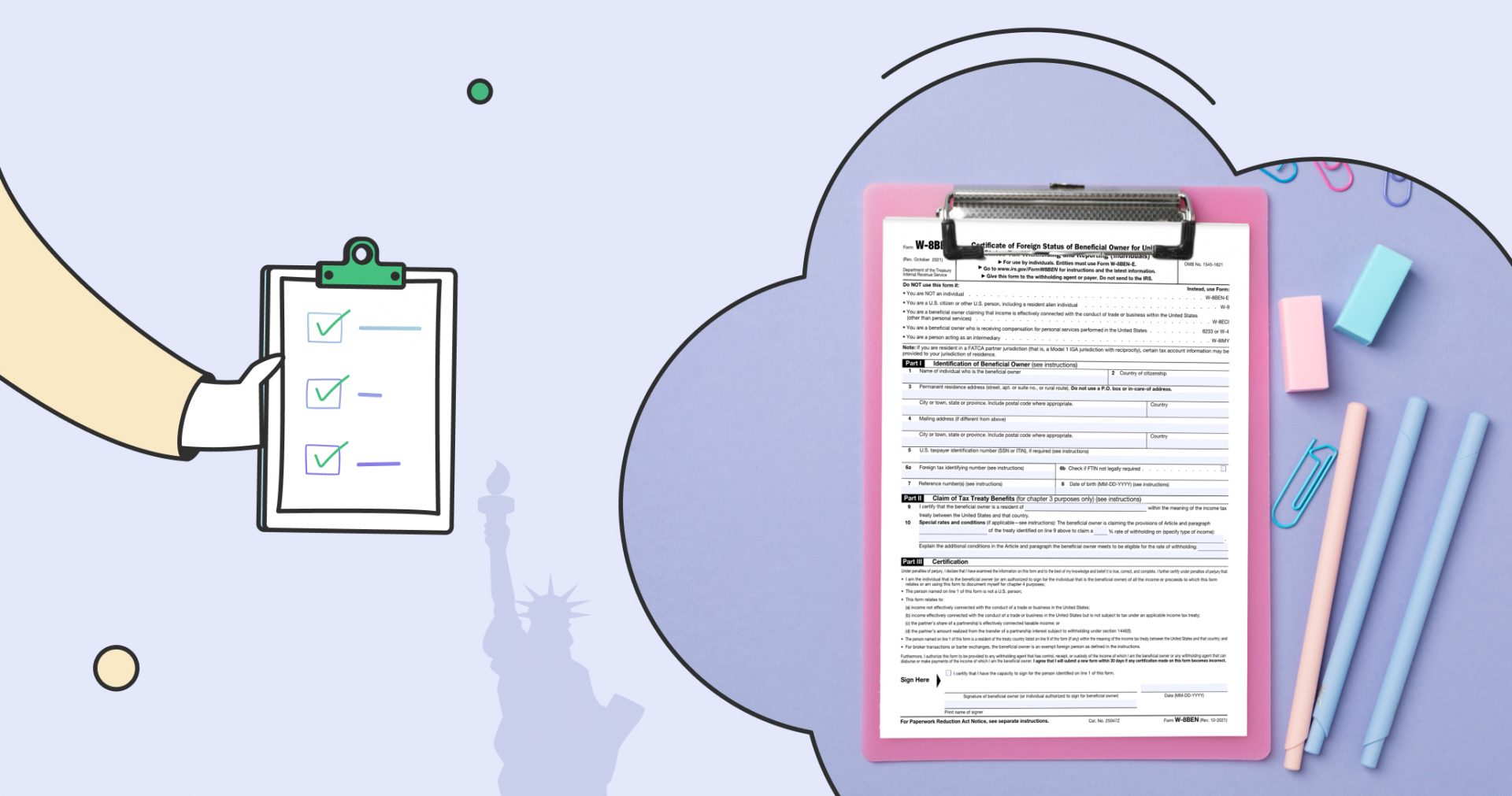

W-8 Ben Form Sample

There are actually five different types of w 8 forms that can be used by foreign individuals or business entities, so if you are filling this out alone, without assistance, it can be worthwhile to know that you have the right one. W 8 ben instructions can be hard to follow for some, so having a visual example can be helpful before putting pen to paper. With this in mind, take a look at this w 8 ben form sample to ensure that there’s no confusion.

Where to Submit W 8 Ben form?

When it comes to w 8 ben form submission, this should not be returned to the IRS but instead to the party that has requested it. This will often be the individual or entity making payments to you. Remember that the w 8 ben is not meant to be filed alongside your tax return, but instead submitted before the first payment is made. The w 8 ben form will expire at the end of the third calendar year once it has been signed, but will need to be filed sooner if there are any changes in circumstances that will potentially affect proceedings.

Common Mistakes with W-8 Ben form

There are a few common mistakes that people make when filling out the w 8 ben form, including:

- Identification errors

- Filling out the w-8 ben when you are not a foreign national

- Incorrect treaty benefit claims

- Failure to sign and date the end of the form

These can be easily avoided by performing due diligence or working with a platform/team to simplify the process.

Get your W-8 Ben form filed with Workhy Today

Why leave your business in the hands of anyone short of the best? Workhy is one of the most reputable online platforms offering everyone from entrepreneurs to well-established businesses the opportunity to connect with an expert team who can take care of all of their needs. Whether you want to get established, need advice regarding finances, or effortlessly grow your business, Workhy is undoubtedly going to transform your experience.